How Budget 2024 Presents an Opportunity to Drive Economic Growth and Consolidation of Our Workforce through Skill India

By CA Sandeep Deshpande

During the recently concluded 2024 Lok Sabha Elections, it was mentioned that more than a Caste Census, our country needs a Skill Census. The government has indeed come up with the Skill India program over the last few years. However, the unorganized workforce still constitutes 93%, as mentioned on the Ministry of Labour and Employment website recently. Here is a case for Skill India consolidation, followed by a few budget suggestions.

The merits of a well-organized and consolidated skilled/semi-skilled workforce are:

Skill Harmonization and Skill Benchmarking.

Ease of Employability across India within the sector of choice.

Skill Upgradation and best practice sharing within India/globally.

Worker’s participation in retirement benefits and access to social security becomes easier.

Direct Benefits Transfer by the government or corporates to eligible skills and skilled categories becomes easier.

Hence, it's essential that the migration of the entire workforce to Skill India happens sooner and faster:

a) Getting all working people (part-time or full-time) who are Indian citizens looking to work, to register for Skill India on the portal/app Skill India Digital in a language of their choice, either themselves or through any skilled mentor (who can register as a partner).

b) A “SHRAM DAAN” mentor is aligned to a batch of skill seekers or skilled/semi-skilled workers. This mentorship is eligible for CPTE credits for social service. These can be the partners who bring skilled/semi-skilled or unskilled resources to the portal. They also receive a minimum fee based on certain criteria.

c) Such registered workers/to-be-working people, who are either already qualified or hold some diploma/certification, will need to give a test to get their skill validated in that sector. (Online test or offline conducted once every quarter).

d) Those who are fresh or don’t have an existing skill certificate or skill can apply for training of their choice after an aptitude test on the portal and then go for employment or freelancing opportunities once training and certification are completed.

e) This registration is not mandatory for members or degree holders of independently formed professional institutions or university degree holders for postgraduate courses, to ensure a level playing field for those who did not have the advantage of such education. This is also not for those who are in UPSC, state services, Indian Armed Forces, etc. While they can register for knowledge certification, they won’t be given preference for employment and related opportunities.

f) They can, however, opt to become mentors, and their shram daan will obtain them CPTE credits from the Skill India Ministry (Certificate of Professional Training Expertise-CPTE). In case of continuous application in this field, they can be considered for Padma Awards as well.

g) All registered individuals must have Aadhar, and once they get skilled or pass the validation test, they also need to have PAN. This will bring the entire Indian workforce under Aadhar and PAN.

h) Each skilled person registered on the Skill India portal will have automatic EPFO, ESI, etc., and a link to their bank account/Jan Dhan Account after their training is completed or validated. The government will make a token contribution per Aadhar and PAN and get them started for those who are trained and made ready for work opportunities.

i) Ayushman Bharat, employment portals, employment exchanges, and campus interviews, etc., will also get linked to them. Even foreign job portals can be allowed for some categories of skills as part of Nation-to-Nation cooperation programs or programs with the UNO/World Bank, etc.

In the 2024 Budget, the government can introduce a scheme wherein it can channel the existing CSR (Corporate Social Responsibility) spend provided under the Companies Act 2013, into two parts after raising the mandatory spend eligibility to 4% instead of 2% as given under section 135 (5) of the said Act, for both listed and unlisted companies. This needs to be spent by the corporates in two parts: with one part mandatorily (i.e., 50%) for Skill India and 50% for other local projects as are taken up by the corporates in the usual course as per the CSR policy of the company.

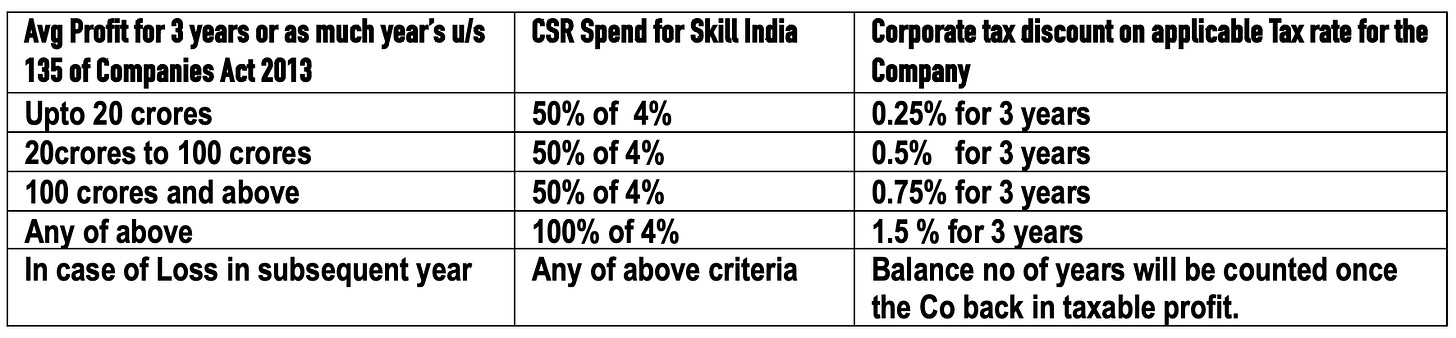

For such corporates who will spend 50% CSR as above for Skill India, there can be a tax rate discount depending on the profit slab below. While up to now the CSR spend is not tax-deductible under the Income Tax Act, it can continue to be so with a slight difference after the 2024 budget, which can be factored as below to incentivize the corporates to spend

Corporates must be given a choice for contributing to their own sector or any sector listed on the Skill India portal or any general contribution if they don’t want to make such choices.

The absolute discount availed must be less than or equal to 90% of the contribution made in the first year when such contribution is made and likewise for every eligible contribution year series. The responsibility for such calculations and audit is on the assessee and their auditors through audit and tax audit reports.

The government can also consider contribution to Skill India in the default regime (i.e., the New Tax Regime) for all non-corporate taxpayers as well, where like corporates, they can also contribute to the sector of their choice as follows but only for those whose taxable income from salary and/or business and profession and/or house property and/or capital gains and/or other sources is more than 25 lakhs per annum. This will make such non-corporate taxpayers eligible for tax rate discounts as below:

The total tax rate discount absolute impact in the above slabs must not exceed 90% of the total contribution made as above. The ITR forms can be designed using software to take care of this.

TDS on Direct Benefits Transfer: Besides the above, those corporates or government companies that engage individual contractors directly or indirectly (not partnerships, LLPs, or private companies) working for them (e.g., in painting, furnishing, construction, education, telecom, tourism, food services, fitness, sports, decoration, marriage industry, etc.), the rate for TDS (basis PAN and Aadhar) can be 0.1% and not the usual 2%, for all digitally made payments up to 7 lacs per annum to each such individual self-employed contractor, directly by the corporate/government company via NEFT/RTGS. This will bring a lot of discipline in ensuring that both remuneration and scheme benefits rolled out by corporates through intermediaries reach the last mile workforce on a timely basis and with minimum delays or detriment from middlemen or distribution channels. The TDS rate also being nominal will support the workforce a bit extra.

Conclusion: Bringing skill consolidation and availing the larger benefits of a skilled workforce in an organized manner is very essential to build the dream of New India in Amrit Kaal.